Volume 33, No. 1: Bright Horizons in 2023

Paying for Post-Secondary Education: No-cost Resources from the CFPB

Leslie Jones, Youth Financial Education Analyst, Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) has resources students and teachers can use to support efforts to prepare and pay for post-secondary education, as well as to protect against frauds and scams associated with funding higher education.

Make a plan for post-secondary education expenses

The average federal student loan burden continues to grow, from about $20,500 in September 2009 to nearly $38,000 at the end of June 2022. While post-secondary education continues to be an investment a student can make in their future self, CFPB recognizes the costs associated with borrowing or paying for higher education. We created the CFPB Paying for College resource page to help students make an informed choice.

The CFPB’s tool, Your financial path to graduation (Grad Path), helps students through the process of reviewing a financial aid offer. The tool helps students:

- Understand their financial aid offer

- Plan to cover the remaining costs

- Estimate how much they’ll owe and if they can afford that debt

- Compare offers from different schools

- Decide what to do next

As you prepare students for post-secondary education decisions, you can use our free, one-day classroom activities on saving for college.

Examine options for paying for higher education

Students can pay for college or graduate school in a number of ways, including by applying for scholarships, grants, and loans. Merit aid and need-based assistance can be awarded to students attending post-secondary career and technical schools.

Students and teachers with questions can turn to our Student Loans resources for more help understanding loan options and other sources for funding higher education.

Stay alert for loan servicing problems and scams

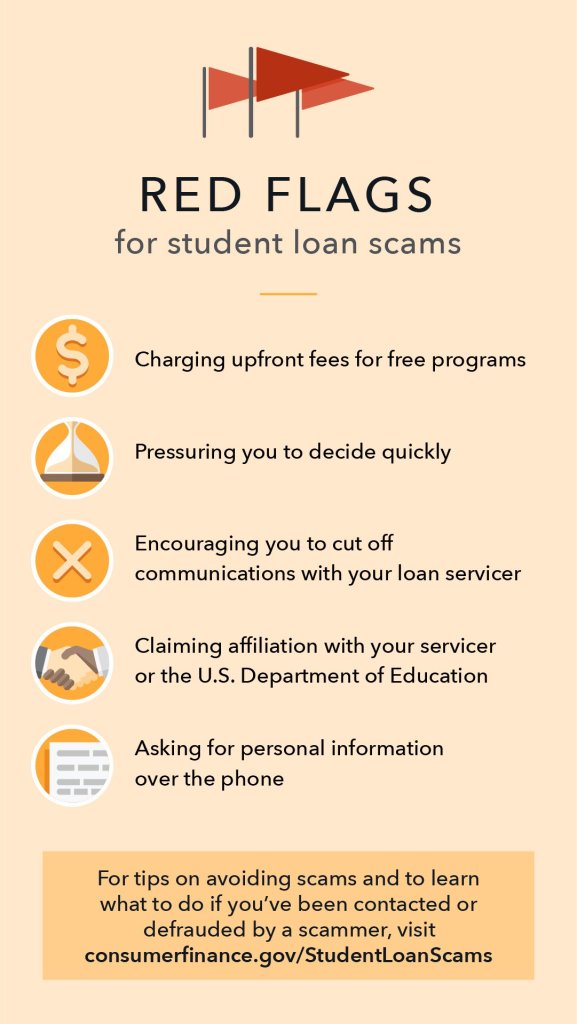

As of October 2022, there were 43.5 million student loan borrowers in the United States. Many borrowers have submitted complaints to the CFPB about receiving inaccurate or incomplete information about their loans from servicers. And numerous student loan borrowers recently submitted complaints about fraud from companies that promised them student loan forgiveness or loan forbearance in exchange for fees amounting to hundreds or thousands of dollars. The graphic shown here outlines some of the warning signs of student loan scams. You can read through the recent report analyzing complaints received about student loans and borrowing over the past year.

People experiencing problems with their student loans or who have been a victim of a scam can turn to the CFPB. If you have a problem, you can submit a complaint online or by calling (855) 411-2372.

The CFPB encourages financial education and capability from childhood through retirement. You can sign up for our e-mail list and stay informed.